Originally posted on September 18, 2025 @ 6:29 AM

IRS Tax Rates 2026: American taxpayers could see some relief in 2026. As per media reports, the IRS prepares to raise federal income tax brackets or IRS Tax Brackets 2026 to keep pace with inflation. These yearly adjustments are meant to prevent workers from being pushed into higher tax brackets simply because their wages rose with the cost of living, not because they actually earned more purchasing power.

When Will the IRS Announce the Changes?

The IRS typically announces updated tax brackets (IRS Tax Brackets 2026) each fall, usually in October or November 2025. While the official numbers are not out yet, analysts are already running the math based on the same inflation data the IRS uses.

How Much Will Brackets Rise?

As per our team reports, the IRS will use a 2.7% inflation adjustment for 2026.

The two lowest brackets — 10% and 12% — will likely get a slightly bigger 4% bump, thanks to a recently passed Republican-backed tax and spending package, often called the “big, beautiful” law.

These adjustments are designed to fight “bracket creep.” Without them, workers receiving routine raises to offset inflation could get taxed at higher rates, even if their buying power hasn’t actually improved.

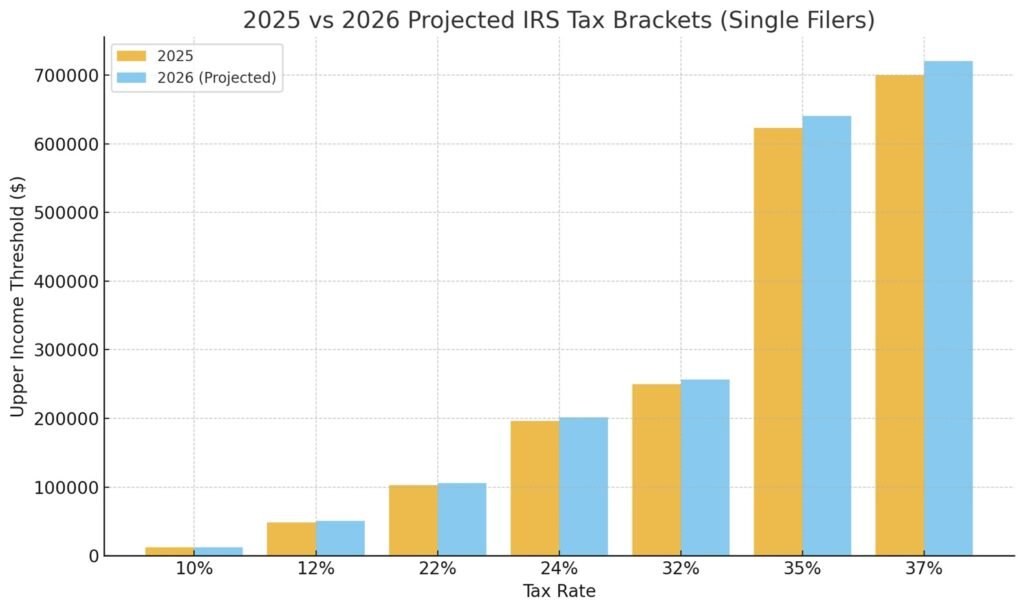

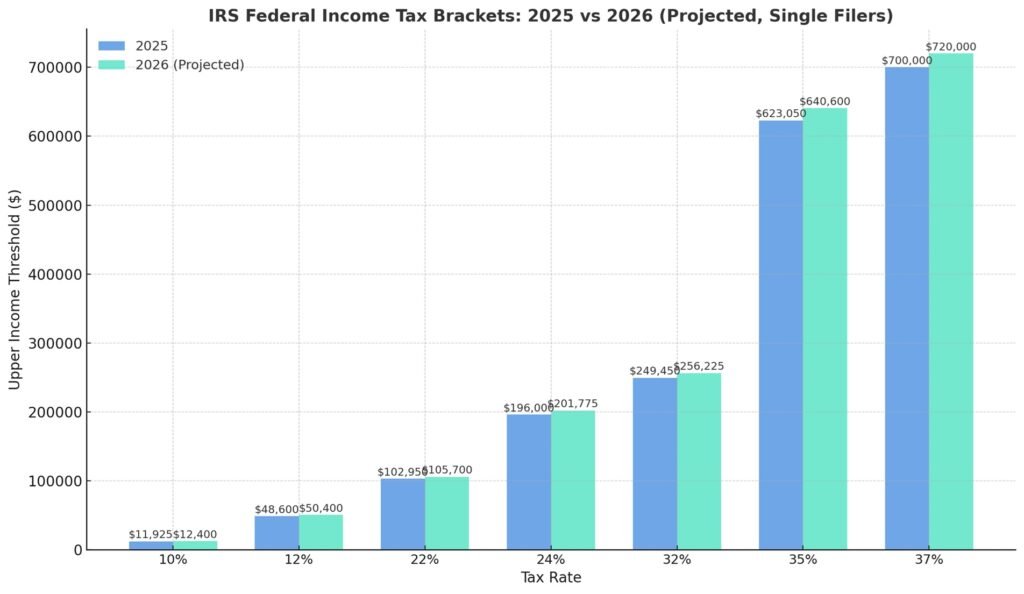

What the IRS Tax Brackets 2026 Could Look Like (Single Filers)

Here are the projected IRS Tax Rates 2026:

10%: up to about $12,400 (vs. $11,925 in 2025)

12%: $12,401 to $50,400

22%: $50,401 to $105,700

24%: $105,701 to $201,775

32%: $201,776 to $256,225

35%: $256,226 to $640,600

37%: above $640,600

Example: In 2025, a single filer earning $50,000 falls partly in the 22% bracket. Under the projected 2026 brackets, that same income would only reach the 12% bracket—meaning more of their earnings would be taxed at lower rates.

Projected Federal Income Tax Brackets: 2025 vs. 2026 (Single Filers)

| Tax Rate | 2025 Income Range | 2026 Projected Income Range |

|---|---|---|

| 10% | Up to $11,925 | Up to $12,400 |

| 12% | $11,926 – $48,600 | $12,401 – $50,400 |

| 22% | $48,601 – $102,950 | $50,401 – $105,700 |

| 24% | $102,951 – $196,000 | $105,701 – $201,775 |

| 32% | $196,001 – $249,450 | $201,776 – $256,225 |

| 35% | $249,451 – $623,050 | $256,226 – $640,600 |

| 37% | Over $623,050 | Over $640,600 |

Extra Tax Breaks Under the New Law

Beyond inflation adjustments, the July 2025 tax package introduced new benefits, including:

An extra $6,000 deduction for seniors

Exemptions from certain taxes on tipped wages and overtime pay for qualifying workers

Preservation of today’s tax rates — 10%, 12%, 22%, 24%, 32%, 35%, and 37% — avoiding a return to the old top rate of 39.6% from before 2017

How Brackets Really Work

A common misconception is that your entire income gets taxed at your top rate. That’s not true. Only the portion of income that falls into each bracket is taxed at that bracket’s rate.

For example: A single filer making $50,000 in 2026 would pay:

10% on the first $12,400

12% on the income from $12,401 up to $50,400

This layered approach ensures most of your income is taxed at lower rates.

IRS Tax Rates 2026 : What’s Next

The IRS is expected to release the official 2026 tax brackets by mid-October to early November 2025. Until then, these projections give taxpayers a good preview of what’s likely ahead.

IRS Tax Rates 2026 : Frequently asked questions on the IRS 2026 Tax Brackets.

1. When will the IRS announce the official 2026 tax brackets?

The IRS usually announces new brackets in October or November each year. For 2026, the updated numbers should be released by late fall 2025.

2. Why does the IRS adjust tax brackets for inflation?

These adjustments prevent “bracket creep,” which happens when workers get cost-of-living raises that push them into higher tax brackets even though their buying power hasn’t really gone up.

3. What are the projected 2026 tax brackets for single filers?

Analysts expect the following ranges for 2026:

10%: up to about $12,400

12%: $12,401 – $50,400

22%: $50,401 – $105,700

24%: $105,701 – $201,775

32%: $201,776 – $256,225

35%: $256,226 – $640,600

37%: above $640,600

4. How does the new law affect these brackets?

The July 2025 tax package, often called the “big, beautiful” law, boosted the lower two brackets (10% and 12%) by about 4%, while other brackets adjust by about 2.7%. It also preserved today’s rates, preventing a return to the old 39.6% top rate.

5. Do higher tax brackets mean my entire income is taxed at that rate?

No. Only the income within each bracket is taxed at that bracket’s rate. For example, in 2026, if you earn $50,000, the first $12,400 is taxed at 10%, and the rest up to $50,400 is taxed at 12%.

6. What other benefits are included in the new tax law?

The law provides:

An extra $6,000 deduction for seniors

Tax exemptions on tipped wages and overtime pay for qualifying workers

Assurance that today’s tax rates (10%–37%) remain in place instead of reverting to higher pre-2017 levels